Problem: The Student Bank Project aims to combat the lack of financial and business skills of poor adolescents in Thailand, mainly at risk individuals, such as those who suffer from ethnic and gender discrimination, immigrants and individuals with HIV/AIDS. Many families in the country do not have access to a bank or any type of information related to financial discipline or planning. The subject is not dealt with in schools. The project began in 2005 and is currently present in 30 schools located in different regions, some of which are rural. In these locations, there is a high rate of debt among the population in addition to low income, which increases the need for educational activities related to family budgets and management of expenses. The organization works in partnership with Citibank and the insurance company Prudential.

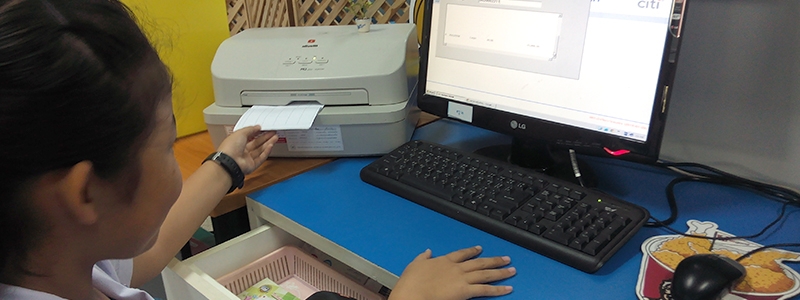

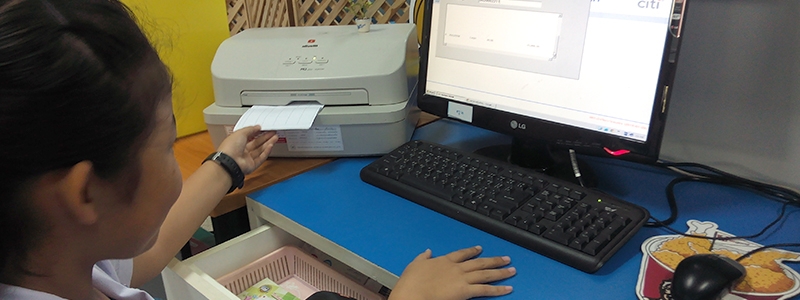

Solutions: In the project, students are trained in theory and practice on how to manage financial risk through socioeconomic education. On an internet banking platform, they can develop their financial skills, gain experience in banking operations, administrative tasks and help in the creation of small businesses. The students of each Student Bank share roles and responsibilities similar to those of a commercial bank, carrying out activities such as those of a manager or accountant. They can also control their accounts, and make withdrawals and deposits. In this manner, they learn to save and to understand the importance of saving money and how their ability to deal with their finances can help them in the present and in the future. The bank at the Wat Kod Tin Taram School, in the east of the country, for example, managed to accumulate a total of US$ 50,000 in savings accounts in two years with the help of the project. The parents of the students can also become clients of the banks, especially those who suffer from difficulties in opening accounts in traditional banks, such as immigrants and indigenous people.

Plan

Plan

Outcomes: The adolescents acquire knowledge in finance and entrepreneurship, important skills that increase their chances of prospering in a fast developing economy like Thailand. The project also contributes to them becoming adults capable of supporting themselves and being productive. With the knowledge acquired in the project, the participants managed to save a total of over US$ 180,000. Among the students, 72% share savings with their parents and help pay bills and expenses. After participating in the project, the total debt of the parents of students fell by 14%. The money is also used for emergencies and to buy school books and material. The organization intends to cover all regions of the country in five years and open one million student bank accounts in 3,500 schools.